The global lithium battery market is witnessing a notable cost upturn, with 3.2V/100Ah LiFePO4 cells leading the surge. This price movement, driven by multi-dimensional factors including raw material fluctuations and supply-demand rebalancing, is reshaping industry dynamics. Below is a comprehensive analysis of the trend, coupled with actionable insights to help market participants navigate the changing landscape—backed by real-time data and Micergy’s decade-long expertise in lithium battery solutions.

Core Highlights

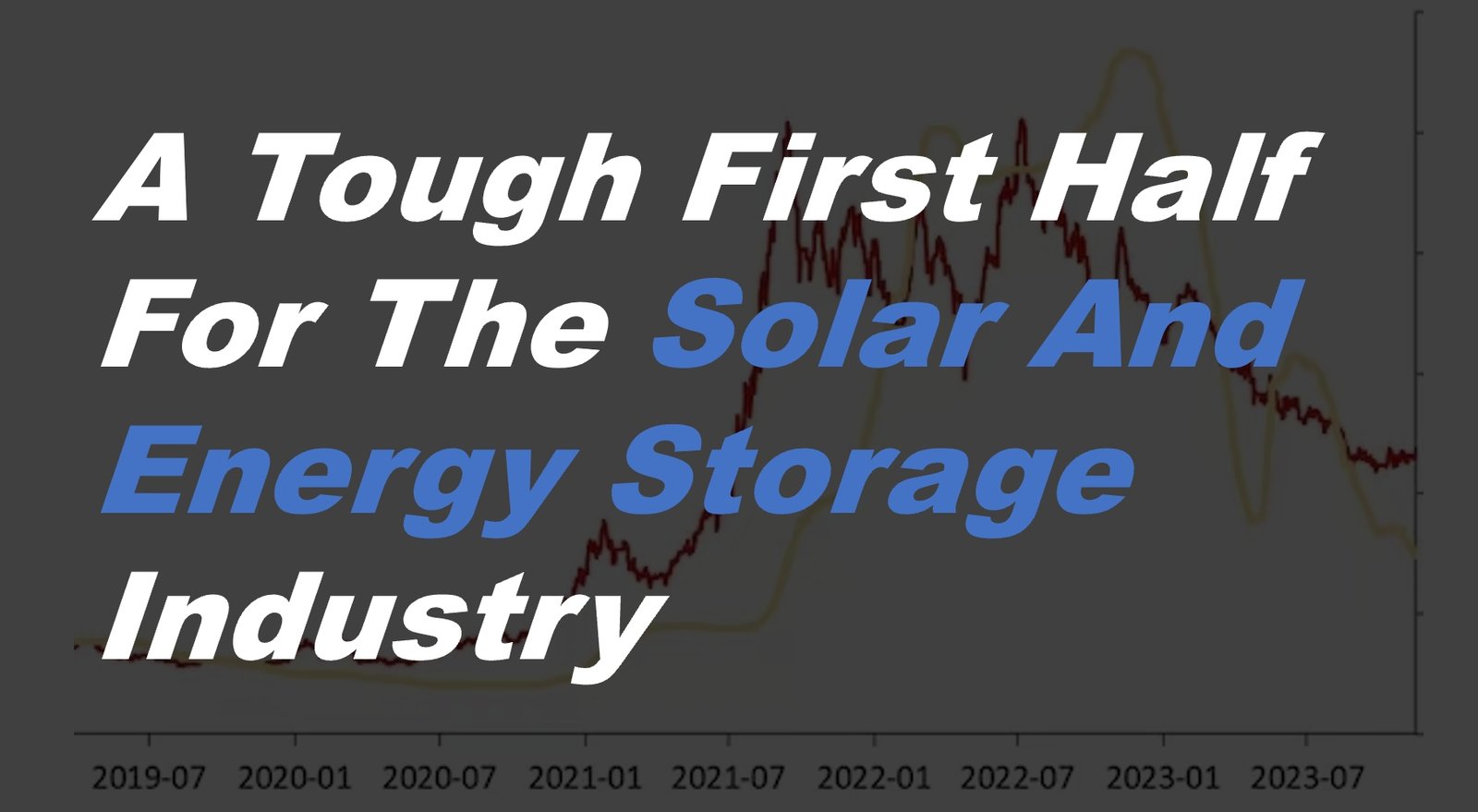

- 3.2V/100Ah Cell Surge: Prices jumped over 20% from early 2025’s 0.33 RMB/Wh to above 0.4 RMB/Wh, with urgent orders exceeding 0.45 RMB/Wh; lead times extended to February 2026.

- Mainstream Cell Uptrend: 314Ah LiFePO4 cells rose nearly 20% in two months (now 0.306 RMB/Wh), while consumer cobalt-acid cells increased by 11.5% .

- Driving Forces: Raw material cost resonance (hexafluorophosphate lithium up 142%), structural supply-demand mismatch, and booming downstream energy storage demand.

- Future Outlook: Short-term prices to stay strong through year-end; 2026 lithium carbonate prices expected to range 80,000-100,000 RMB/ton, supporting steady cell cost growth .

I. Why Are 3.2V/100Ah LiFePO4 Cells Surging?

1. Raw Material Cost Pass-Through

A full "price increase chain" has emerged from upstream materials to cells. Hexafluorophosphate lithium (a key electrolyte material) soared from 47,000 RMB/ton to 125,000 RMB/ton (+142%), while lithium carbonate rebounded over 10% from its June 2025 low to near 70,000 RMB/ton. Phosphoric acid and yellow phosphorus, core inputs for LiFePO4 cathodes, also saw tight supply, pushing cathode material costs up by 4,000 RMB/ton. These cost pressures directly translate to higher cell production expenses.

2. Structural Supply-Demand Mismatch

Global residential energy storage demand has exploded, making 3.2V/100Ah cells a core model for small-scale storage applications. However, leading battery makers have focused capacity expansion on 300Ah+ large cells (for utility-scale storage cost advantages), leaving 100Ah cell supply insufficient. This imbalance was highlighted by the failed bidding for 100Ah cell packages in a 7.248GWh energy storage procurement project, reflecting acute supply shortages.

3. Booming Downstream Demand

LiFePO4 batteries account for 81.4% of power battery installations, with cumulative shipments up 88% year-on-year. Energy storage demand is even more robust—Q4 2025 downstream production schedules are rising month-on-month, and cell manufacturers like EVE Energy and Pien Technology are operating at full capacity with saturated orders. The dual growth in the automotive and energy storage sectors has created an unprecedented demand pull for key cell models.

Strategic Alternative to 3.2V/100Ah Cells

For most market participants, it’s prudent to rethink reliance on 3.2V/100Ah cells unless they are irreplaceable for specific applications. Choosing cells with slightly lower (e.g., 90Ah) or higher (e.g., 120Ah) capacity can deliver significant cost advantages—their cost per Wh is typically 15-25% lower than 3.2V/100Ah cells. This cost gap stems from more balanced supply-demand dynamics for these alternative models, as mainstream manufacturers haven’t shifted their production focus away from them to the same extent as 100Ah cells.

Crucially, these alternative capacities maintain comparable performance and lifespan to 3.2V/100Ah cells. They retain the same LiFePO4 chemical properties, offering more than 6,000 deep cycles and stable discharge performance. For most scenarios—including residential energy storage, RV power systems, and marine applications—the slight capacity adjustment won’t hinder operational efficiency. In fact, proper system configuration can fully compensate for the capacity difference while slashing long-term costs.

It’s also important to recognize that the current cost surge of 3.2V/100Ah cells is unsustainable. The price spike is primarily driven by a short-term supply-demand mismatch, and as new production capacity comes online and manufacturers adjust their product mix, supply will gradually catch up with demand. Investing in 100Ah cells at their current price peak risks unnecessary cost burdens.

Above all, integrity remains non-negotiable. When adopting alternative capacity cells, it’s essential to truthfully disclose the actual capacity to customers—avoiding false labeling or overpromising. This not only complies with industry regulations and builds long-term trust but also aligns with Micergy’s commitment to transparent and responsible business practices.

About Micergy

Micergy started lithium battery manufacturing in 2009 and provides custom lithium battery products for different sectors, including energy storage batteries, lighting electric vehicle batteries, and custom batteries for golf carts, Marine, RV, and Forklifts. Besides, not limiting ourselves to the R&D of BMS to protect the battery and lengthen the lifespan, relying on the competitiveness of the battery, Micergy further embraces the IoT technology and developed comprehensive 'Energy + IoT' solutions for various sectors to solve the affordability problem of product with a high upfront cost.